R&D tax credits

The New Zealand R&D tax incentive provides a 15% tax credit on eligible research & development expenditure with a minimum annual R&D spend of $50,000.

10% of the claim can relate to expenditure for R&D performed overseas

The programme requires all activities to be presented for upfront review and approval. Claimants apply for pre-approval for eligible R&D activities for up to three income years.

If your R&D business is in a tax loss position or you do not have enough income tax to pay to use up all of your R&D tax credits, you may be eligible for refundable R&D tax credits (i.e cash back). These are designed to help smaller businesses with cash-flow challenges.

The tax credit for R&D tax losses is at a rate of 28%. If both programs are accessed together, the total refundable tax credit rate can be up to 43% (15% + 28%)

R&D Grants vs. R&D Tax Credits

In New Zealand, R&D tax credits have largely replaced government-funded R&D grants. While there are many similarities between navigating the grants process and claiming R&D tax credits, our team is here to guide you every step of the way.

We provide comprehensive support with all aspects of R&D tax incentives, ensuring you maximize the benefits available to your business.

Maximising your R&D Tax Incentives

Our expertise ensures your business maximises R&D tax credit opportunities. Whether you’re navigating the transition from R&D grants or seeking cash refunds for innovation, we’re here to make sure the process is seamless.

Contact us to learn more about how we can help your company benefit from R&D tax incentives (RDTI) in New Zealand.

Cash back when loss making

By claiming refundable R&D tax credits, your business can access much-needed financial support, even if you’re not yet generating taxable income. This can be a crucial lifeline for R&D companies focused on innovation and growth.

Contact us to learn more about how we can help your company benefit from R&D Loss Tax Credits (RDLTC) in New Zealand

the resources guys (TRG)

Since our founding in April 2000, The Resources Guys (TRG) have become New Zealand’s trusted experts in R&D support. We’ve secured over $100 million in R&D grants for our clients, placed funded interns, obtained R&D tax refunds and credits, and facilitated key connections that drive innovation and growth.

Our team of technologists is skilled in a wide range of industries and technologies, allowing us to provide comprehensive guidance. Whether you need full management of the R&D tax incentives process or assistance with specific stages, our flexible approach ensures you receive tailored professional services to suit your business needs.

Get in touch to learn how we can help your company maximise R&D tax credits, and refunds in New Zealand.

LET’S TALK ABOUT YOUR R&D PLANS – HERE ARE OUR CONTACT DETAIL

LET’S TALK ABOUT YOUR R&D PLANS – HERE ARE OUR CONTACT DETAIL

R&D Tax Credit Management Services

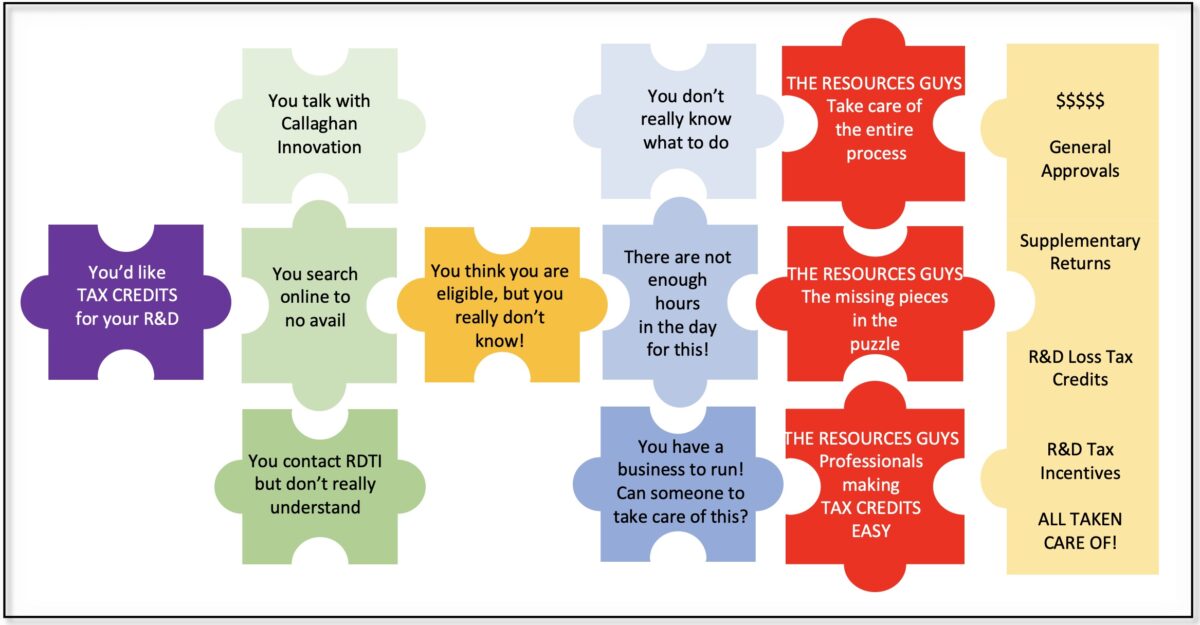

Managing the R&D tax credit process can be straightforward if you have prior experience, time, and access to both technological and financial expertise. If that sounds like you, you may not need our assistance.

However, if you need support, we’re here to manage the entire R&D tax credit process for you. From start to finish, we ensure that every phase runs smoothly, taking the burden off your team and maximising your tax credits.

We’ve had the pleasure of working with clients across a variety of technology industries, including…